Before you make any decisions on how to handle the situation, you’ll want to do some fact checking.

Confirm Identity

First things first, you will want to reexamine the background check results to ensure that the check was run on the correct person. Work with your screening company to verify that all of the information on the employee matches exactly. This is especially important with people that have common last names like Smith, Thomas or Jones. In these cases, even the middle initial can be the same so you will want to verify date of birth, addresses and any other pertinent information to be sure the results of the background check are for the right person.

“People with common names — there is a significant risk that they’re going to get a background check that has nothing to do with them that shows a criminal record that doesn’t exist. And it is going to harm them when they are trying to get employment,” according to Paul Strauss of the Chicago Lawyers Committee for Civil Rights.

If you find out that there was a mistake in identity, re-run the background check on the correct person and cross your fingers that this time you get a clean check.

Confirm Adverse Actions

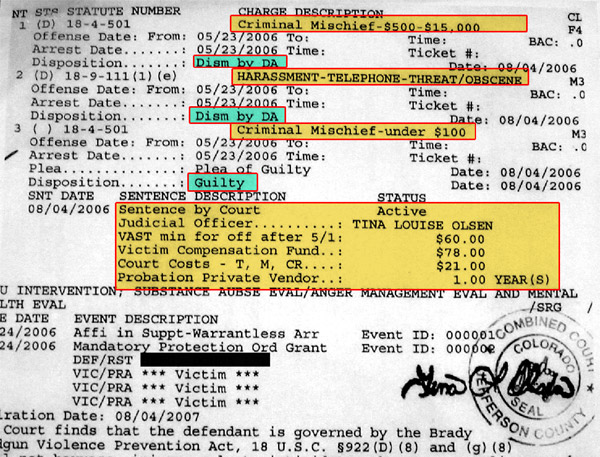

Next you will want to confirm that any adverse actions that came back on your new employee are valid. Once again, work with your screening company to determine if any criminal records reported are accurate. For instance, you may find out that your employee was arrested for a crime, but he/she may not have ever been convicted. Your screening company should have verified that any adverse actions were valid on the report before delivering the results, but you as the employer also have a responsibility to confirm that the checks were in place.

You will want to find out if the background check company used a court runner to verify the results as well. Court runners are people that physically go to the court house to manually pull any criminal records and verify that they are accurate. Here’s a scenario where this would be important:

Let’s say that a criminal record came back on a background check but the employee was absolved of the crime. For some reason, the county has not updated the electronic file yet and it still shows that the case is open. This is where a court runner can be extremely important. The court runner will be able to pull the physical paperwork, determine the status of the case and report the results to the background check company.

Review Company Policy

You’ve done all the research – twice – and confirmed that your new employee really does have a criminal record. Now what? Now it’s time to review your company policy and any paperwork signed by your new employee.

What is your policy on criminal records? Not every criminal offense is a deal-breaker when it comes to obtaining employment. Was the offense minor or major? How does the offense relate to the position that the employee was hired for? These are things that need to be taken into consideration before you just throw away all of the work done to choose that employee in the first place.

Also, did you supply your employee with proper paperwork advising them that the employment offer was valid pending the background check results? Once you’ve extended an offer to a job applicant and they accept, you must ensure that you are within your legal rights to rescind employment based on the screening results.

Action Letter

Once all of these checks have been completed, it is time to notify your employee of the results that came back. This is done through a pre-adverse action letter and in many cases is done by the background check company as part of their services. The letter will include the following components: a copy of the background check report, notice of possible termination of employment and a summary of their rights as detailed by the Fair Credit Reporting Act (FCRA).

Last Chance

Once the employee has received notification of pre-adverse action, this is their last chance to win you over. They have the right to dispute any of the data on the report or provide an explanation on the circumstances of the offense. Maybe they can convince you that there was a good reason behind the offense or that they are still worth keeping on despite the results of the background check.

Final Action Letter

If after you have reviewed your policies, notified the employee and discussed the situation with your employee, you feel that this employee is no longer the right fit for your company, then the final step is to send the adverse action letter.

The adverse action letter should include another copy of the background check, a summary of their FCRA rights and the name of the background check company that provided the results. Additionally, the letter must state that the job offer has been rescinded based on the results of the accompanying background check.

Why so Much Fuss?

While it may seem to be extremely time-consuming and inconvenient to follow the guidelines provided here when an employee fails a background check, each one is very important to ensure you are compliant with the law. FCRA lawsuits have become common and can become so costly that they can easily bankrupt a company even before a decision has been made by the courts.

Don’t jeopardize your background check results. Rely on a background check company that is professional and experienced and will deliver accurate reports the first time. SB Check’s professionals have more than 30 years combined experience in delivering accurate results the first time. Call (888) 725-2535 today or visit sbchecks.com.