Misconceptions in Using Credit Checks in Employment Screening

A common misconception of credit checks being used in employment screening is the use of credit scores. CreditSesame.com’s John Ulzheimer spoke with representatives at the three national credit reporting agencies to clarify this subject. All three agencies agreed that credit scores are never used in employment screening. Ulzheimer reported his findings in a blogpost. “According to an Equifax spokeswoman, ‘Federal law allows potential and current employers to view a modified version of your credit report. Credit scores are not sold for employment screening purposes.’”

What’s the Difference?

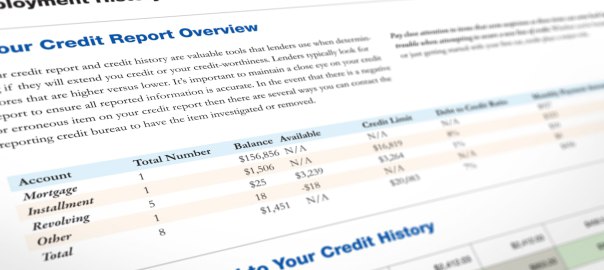

Some people may be confused when it comes to credit checks vs. credit scores. According to Bankrate.com, “your credit score is a three-digit number generated by a mathematical algorithm using information in your credit report. It’s designed to predict risk, specifically, the likelihood that you will become seriously delinquent on your credit obligations in the 24 months after scoring.” A higher number means a lower risk for defaulting on loans.

Credit checks are different. Credit checks review your credit report which is a running list of your credit obligations throughout your lifetime. These reports include any credit cards, mortgages, student loans or other financial commitments made to a lender. The Consumer Financial Protection Bureau adds, “This information includes how often you make your payments on time, how much credit you have, how much credit you have available, how much credit you are using, and whether a debt or bill collector is collecting on money you owe.”

The Pros

One reason employers utilize credit checks in employment screening is to lower the likelihood of employee theft. Employers like to know that a job candidate acts responsibly by paying their bills. This theoretically lowers the chances that the person would steal or embezzle funds from the company to fix their personal finances. This is especially true in those positions that have direct access to company funds.

Many employers believe credit checks predict how an employee will perform. In other words, an employee who acts responsibly with their own finances will in turn be responsible in their job. In other words, an outstanding credit report will likely equate to an outstanding employee. Likewise, it is argued that a person’s inability to meet financial obligations is a direct indicator of a lack of responsibility and reliability.

In 2009, The Transportation and Security Administration was under fire for its practice to discriminate against hiring employees with financial delinquencies. The TSA defended its practice. CreditCards,com cited spokesperson Lauren Gaches who defended the practice. “Beyond the basic requirement, TSA’s background investigations and credit checks get to the larger issue of insider threat. Employees who cannot meet their just financial obligations may be subject to pressures that could undermine security,” she says.

The Cons

Lawmakers are stepping up and rallying against the use of credit reports. Many feel that the practice is just another form of discrimination. “Just as we successfully worked to prevent discrimination in the workplace based on one’s age, race or religion, we now need to work to prevent discrimination based on one’s credit history,” said Babette Josephs, a former member of the Pennsylvania House of Representatives.

A study published by Robert Clifford, Federal Reserve Bank of Boston, and Daniel Shoag, Harvard University and National Bureau of Economic Research in June, 2016 finds that banning the practice can have a positive impact. “We find, robustly, that these bans raised employment in low-credit areas. Our baseline specifications indicate that low credit score tracts (e.g., average credit score below 620) saw employment increase by roughly 3.7–7.5 percent relative to trends within the state and relative to low credit score tracts in states without these bans,” the study reports.

Sandy Shore, a senior credit counselor with Novadebt, believes that the practice of using credit reports could hurt employers as well as employees. “If there is no correlation, then employers who don’t hire consumers with bad credit could be missing on out some good employees,” she says.

The Movement

In 2007 the first state passed a law to restrict the use of credit reports in employee screening. As of June, 2016, California, Colorado, Connecticut, Hawaii, Illinois, Maryland, Nevada, Oregon, Vermont and Washington all have laws in place to regulate their use. In addition, several municipalities have implemented their own laws regarding these practices. Philadelphia is the most recent example with laws that go into effect on July 7, 2016.

Laws on employment applications and screening processes are continually changing, leaving employers vulnerable to lawsuits if they don’t adhere to the policy updates. SB Checks makes it our business to understand how these changes affect your hiring procedures. Call 888-725-2535 today to ask about our screening solutions.